Archive for September 2018

Back to School – Retirement Edition

School’s in session! Are you asking the right questions? Read more.

Read MoreDoes Volunteering on the Board of Directors Come with Fiduciary Liability?

Liability is a complicated topic. If the plan is an ERISA plan, then state law is immaterial. Compensation has zero impact on whether an individual is a fiduciary. It is role and control that are the determinants. Read more.

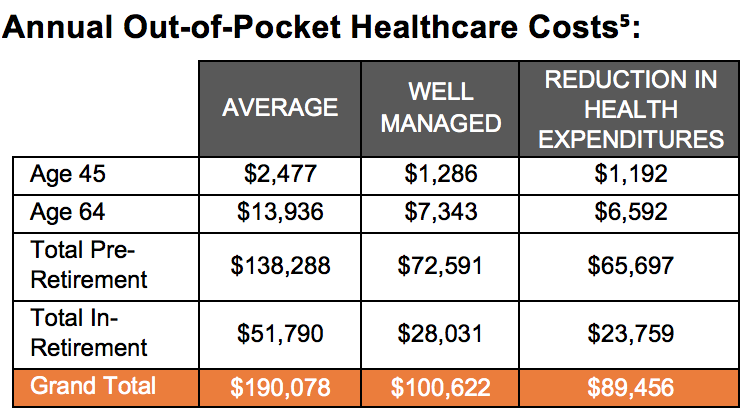

Read MoreHealth Modification Can Increase Retirement Dollars

A top concern for individuals nearing retirement is out-of- pocket healthcare costs. A recent survey revealed that 74 percent fear out-of-control healthcare costs, and 64 percent are terrified of the effects they may have on their retirement plans. Read more.

Read MoreUse Plan Analytics to Evaluate Your Retirement Plan

Your retirement plan is a valuable resource for your employees and serves as a vehicle to attract and retain top talent. Ensuring plan success is crucial. Examining plan analytics can help evaluate its success. Read more.

Read MoreDoes Forcing Out Terminated Participants Create a Fiduciary Liability?

Is there regulatory guidance that would indicate whether forcing out terminated participants is favorable to keeping them in? What fiduciary liabilities are absolved by forcing them out? Read more.

Read MoreHSAs Can Be An Integral Part of a Competitive Benefits Package

Health care expenses are one of the most critical issues that workers and employers face today. Historically, both health care and retirement savings have largely been kept separate, but that conversation is changing. Read more.

Read MoreCITs – The Fastest Growing Investment Vehicle Within 401(k) Plans

For almost a century, collective investment trusts (CITs) have played an important role in the markets. They were originally introduced in 1927. A 2016 study showed that they are the fastest growing investment vehicle within 401(k) plans. Read more.

Read More