PLAN DESIGN

Enormous resources are used to encourage employees to participate in their employer’s retirement plan. Yet three decades after the debut of defined contribution, employees still contribute too little to their plan or not at all, leaving them ill-prepared for retirement. Why?

The problem isn’t education, access or, as some claim, a “broken” system. It’s, in a word, inertia. Employees struggle to act in their own best interests even when they know it could improve their financial future. That’s why employers need to ensure that it takes less effort to succeed at saving for retirement than to fail.

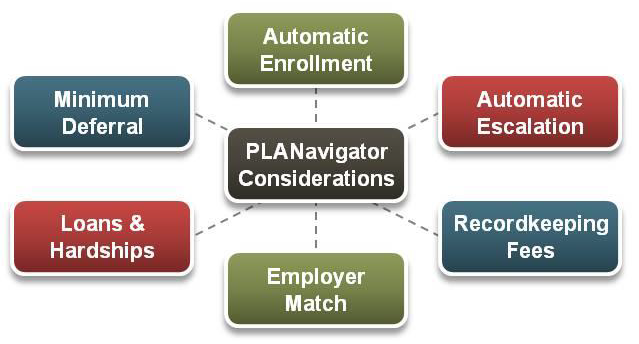

We work with you to implement plan design elements that will drive employee participation and engagement to ensure that employees are being steered in a desired direction… towards the path to successful retirement outcomes.

Through strategic partnership with ERISA attorney’s, actuaries and compliance managers, we offer:

- Plan design and feasibility studies

- Fee and expense analysis (direct and indirect)

- Plan document services

- Regulatory consulting and compliance support

- Non-discrimination testing compliance review

- Form 5500 filing compliance review and monitoring

- Merger / acquisition due diligence consulting

- Legislative and regulatory updates